The tax will apply from April 2025, the chancellor said in his Autumn Statement.

Nissan, which makes several electric models, said it was concerned about the potential impact on sales of the new tax.

Tim Slatter, the UK chairman of Ford, described the move as “short-sighted”.

“We are still many years from the ‘tipping point’ when electric vehicles will reach cost parity with petrol and diesel vehicles. Until then, we should be incentivising customers to make the greener choice,” he said.

Electric vehicles registered from April 2025 will pay the lowest rate of vehicle excise duty (VED) in the first year, then move to the standard VED rate, currently £165. Those registered from April 2017 will also pay the standard rate.

In his Autumn statement, the chancellor said half of all new vehicles would be electric by 2025 and the decision was designed “to make our motoring tax system fairer”.

A spokesperson from Nissan told the BBC: “We’re concerned about the effect that withdrawing this customer incentive could have on the electric car market, just as it is accelerating.”

The firm said it would continue to work with the government to tackle “the main barriers to the electric vehicle transition, including public charging and measures to continue to support the purchase of EVs”.

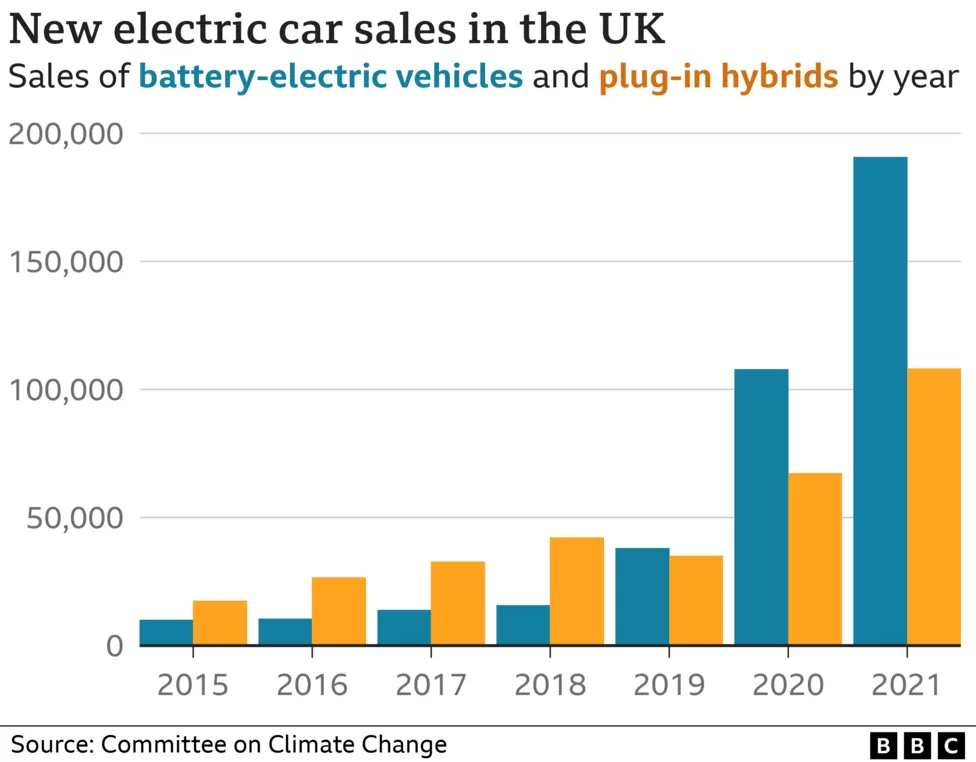

This year so far, 195,547 battery electric vehicles have been registered in the UK, but they still made up less than 15% of all registrations – according to the SMMT, the UK car manufacturers’ trade body.

Sales are expected to continue to rise. From 2030 the sale of new purely petrol and diesel cars will be banned in the UK.

Kia said electric vehicles had made up more than 16% of its total UK sales so far this year.

The firm’s spokesperson said the government decision to extend the tax to electric vehicles, while pushing for their accelerated rollout, was “at odds with the country’s net-zero ambitions”.

In the Autumn Statement the chancellor also announced that electric cars would no longer be exempt from the expensive car supplement. The supplement of £355 is charged every year from the second to sixth year of registration for vehicles priced at more than £40,000.

The SMMT described this as the “sting in the tail”, warning it would unduly penalise new, more expensive vehicle technologies.

SMMT chief executive Mike Hawes called for a “framework that encourages consumers and businesses to buy electric vehicles”.

Edmund King, AA president, said his organisation understood electric cars would need to be taxed, but said the measures in the Autumn Statement would “slow the road to electrification” and “dim the incentive to switch”.

The RAC disagreed, saying it was “probably fair the government gets owners of electric vehicles to start contributing to the upkeep of major roads from 2025”. The RAC doesn’t expect the move to dampen demand, given the “many other cost benefits” of running electric vehicles.

In June the government announced it was closing the plug-in grant scheme, which subsidised electric vehicle sales, to new orders, saying it had already helped boost uptake.

In February a group of MPs urged the government to consider a “pay-per-mile” scheme to replace current motoring taxes, as the country moves away from petrol and diesel vehicles.

Fuel duty brings in roughly £26bn per year, but the transition to electric vehicles will reduce that. Currently vehicle excise duty brings in about £7bn per year.