Alexa is on life support.

When the voice assistant first launched in November 2014, publications called it the “computer of the future.” CNET described it as something out of the sci-fi series “Star Trek.” Computerworld heralded the product as the “future of every home.”

Nearly 10 years since, the voice assistant hasn’t lived up to Amazon’s expectations.

During the first quarter of this year, Amazon’s “Worldwide Digital” unit, which includes everything from the Echo smart speakers and Alexa voice technology to the Prime Video streaming service, had an operating loss of over $3 billion, according to internal data obtained by Insider.

The vast majority of Worldwide Digital’s losses were tied to Amazon’s Alexa and other devices, a person familiar with the division told Insider. The loss was by far the largest among all of Amazon’s business units and slightly double the losses from its still nascent physical stores and grocery business.

While Amazon’s business model has traditionally tolerated this kind of poor financial performance from its hardware businesses, that’s no longer true. Amazon’s Alexa and the devices team at large is now the prime target of the biggest layoffs in the company’s history, according to press reports and an internal email seen by Insider.

Insider spoke with over a dozen current and former employees on the company’s hardware team to get a better picture of its current condition. They described a division in crisis. While Alexa was once one of the company’s most rapidly growing projects, the mounting losses and massive job cuts underscore the swift downfall of the voice assistant and Amazon’s larger hardware division.

It also punctuates the failure of the company’s much-replicated business model of selling devices at cost and to recuperate revenue from additional purchases later.

Employees spoke under the condition of anonymity because they weren’t authorized to speak with the press. Their identities are known to Insider.

“Alexa is a colossal failure of imagination,” one former employee said. “It was a wasted opportunity.”

While Amazon didn’t respond to Insider’s questions about the health of its devices and voice-assistant business, Amazon’s senior vice president for devices and services, David Limp, said in a statement, “We are as committed as ever to Echo and Alexa, and will continue to invest heavily in them.”

When Alexa launched, it pioneered a new business model for the company. The goal wasn’t to sell more units like a traditional hardware company. Instead, Amazon wanted shoppers to buy more things through Echo devices by placing orders through the voice assistant. As one internal document put it: “We want to make money when people use our devices, not when they buy our devices.”

The first-generation Echo device was a surprise hit, selling over 5 million devices in its first two years, according to Consumer Intelligence Research Partners. Amazon doesn’t disclose sales figures for Alexa or its related devices.

By 2016, the device even starred in Amazon’s Super Bowl commercial. Two years later, Alexa’s team nearly doubled in size with more than 10,000 employees.

The product was also Jeff Bezos’ brainchild, which made it one of the most popular teams at Amazon. The Amazon founder stayed engaged with the development of Alexa. He even personally reviewed the product’s email marketing campaigns, one person directly involved in the project told Insider.

Bezos was also the team’s biggest advocate, pushing it to reduce Alexa’s response time far below industry standards. He also came up with out-of-the-box ideas like the short-lived Alexa-powered microwave oven.

In comparison, Limp, the senior vice president who oversaw Alexa, was less enthused by the first Echo device. According to two former employees, he rarely used it during its beta-test period.

The honeymoon period didn’t last long.

Four years after launch, the product was embroiled in controversy. Reports of Alexa mistakenly sending voice recordings to the wrong person or Amazon employees secretly listening to private conversations stoked privacy concerns.

And the first cracks in the products business model began to show. Internally, the team worried about the quality of user engagements. By then Alexa was getting a billion interactions a week, but most of those conversations were trivial, commands to play music or ask about the weather. That meant fewer opportunities to monetize. Amazon can’t make money from Alexa telling you the weather — and playing music through the Echo gives Amazon only a small piece of the proceeds.

By 2018, the division was already a money pit. That year, The New York Times reported that it lost roughly $5 billion. This year, an employee familiar with the hardware team said, the company is on pace to lose about $10 billion on Alexa and other devices.

At an all-hands meeting in 2019, Limp acknowledged those concerns. For Alexa to get to the “next level,” he said, it needed to improve both user engagement and security.

“We can do both things: increase engagement and make sure customers trust the interactions with her. It’s a very, very bright future as we move forward,” Limp said, according to a recording of the meeting obtained by Insider.

Still, employees said Alexa continued to struggle financially. While the product ranked among the best-selling items on Amazon, most of the devices sold at cost.

By late 2019, the company effectively froze hiring for the team, three former employees said. Though they were backfilling roles, the company didn’t expand the group through new hires. Employee morale also began to tank as the once promising project was clearly losing steam.

The team tried to use a variety of metrics to measure the true financial impact of Alexa.

They even hired a team of experts to track the behavior of Alexa and Echo users on Amazon, and how they were likelier to spend more on Amazon.com or sign up for Prime membership. But even so, its financial contribution often fell short of expectations, more than half a dozen employees told Insider.

In 2020, Bezos’ interest in Alexa began waning. He stopped commenting on the email campaigns, and the team quietly ceased sending executive updates about it, one employee involved in marketing said.

Other opportunities to monetize the device had also fallen through. Shortly after launching the first Echo device, the company released the Skills app, a tool to create voice-activated shortcuts to call cabs or order pizzas. Early on, companies like Uber, Disney, and Domino’s Pizza took advantage of the tool, but it failed to generate engagement. By 2020, the team stopped posting sales targets because the lack of use, one employee said.

Attempts to build a developer community around Skills also failed to catch on. The Alexa Live developer conference, for instance, saw sign-ups continue to drop in recent years, an employee familiar with the conference said.

Attempts to build a developer community around Skills also failed to catch on. The Alexa Live developer conference, for instance, saw sign-ups continue to drop in recent years, an employee familiar with the conference said.

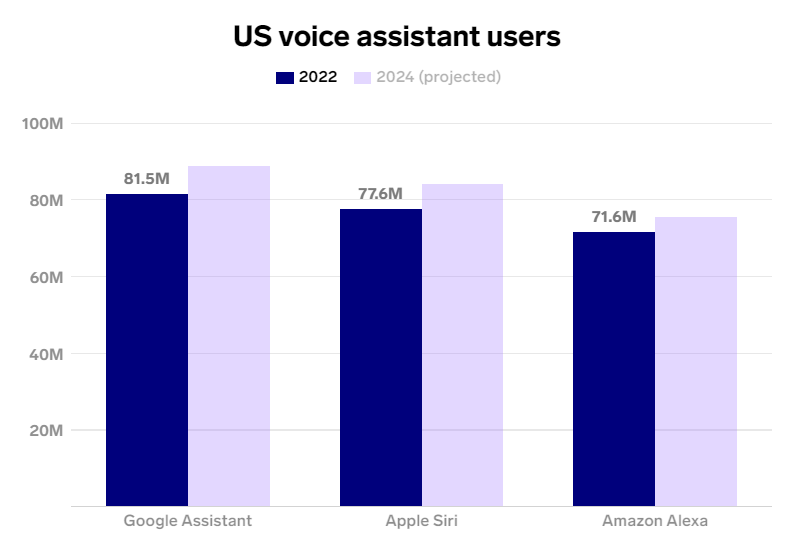

Alexa also couldn’t compete after its competitors Google and Apple doubled down on the technology. In the US, Google Assistant currently leads with 81.5 million users, followed by Apple Siri’s 77.6 million, according to Insider Intelligence. Alexa is now the third-largest, with 71.6 million users.

Amid the loss in revenue, market share, and layoffs, some employees said the team’s strategy had also been confusing lately.

While, according to internal documents, Amazon’s hardware team planned on building an updated set of wireless headsets and a new type of augmented-reality product, it’s unclear how many of these projects will survive Amazon’s cost-cutting.

Amazon has long targeted the budget customer by releasing more-affordable devices, but now the company seems more invested in Astro, its $1,000 home robot. Employees told Insider the product was Bezos’ latest pet project.

Amazon’s decision to go after the high-income crowd sparked controversy and internal dissent, several employees said.

There’s no clear directive for devices.

CEO Andy Jassy in a now-public note committed to investing in Alexa, but employees said it’s unclear what the future of the product holds.

Some blamed Amazon’s lack of interest in selling more devices. There’s little incentive to spend more on building popular products that “people really want,” one employee said. “There’s no clear directive for devices,” they added. “What are we trying to do? Be the best? The cheapest? When that part is not clear, you end up with competing factions.”

mployees told Insider a combination of low morale, failed monetization attempts, and lack of engagement across users and developers made them feel as though the team was deadlocked over the past few years.

The company’s leadership was also notably silent after reports surfaced last week that Alexa would be the primary target of layoffs, leaving employees scrambling to figure out how they’d actually be affected.

It was only on Wednesday when Limp sent a teamwide email to confirm the reports.

“It pains me to have to deliver this news as we know we will lose talented Amazonians from the Devices & Services org as a result,” Limp wrote. “I am incredibly proud of the team we have built and to see even one valued team member leave is never an outcome any of us want.”

The division’s high-profile executive departures haven’t helped either. In August, Lab126’s president, Gregg Zehr, who was responsible for many of Amazon’s personal devices, retired after 18 years at the company. Tom Taylor, the senior vice president of Alexa, also announced his retirement on the same day, putting an end to his 22-year Amazon career.

This disarray is also leading to sloppy customer support. Earlier this year, Amazon discovered that a voice shortcut that allowed users to ask for the items on their cart in its mobile app was not working in India and the US, according to an internal document. The problem was unnoticed for over 200 days in India and for 35 days in the US before the team fixed it.

While Alexa may have lost its luster under the largest shake-up in Amazon’s history, employees said the company had a new favorite child: That title now belongs to its burgeoning healthcare business.